Edmonton Market Snapshot: What Sellers Need to Know

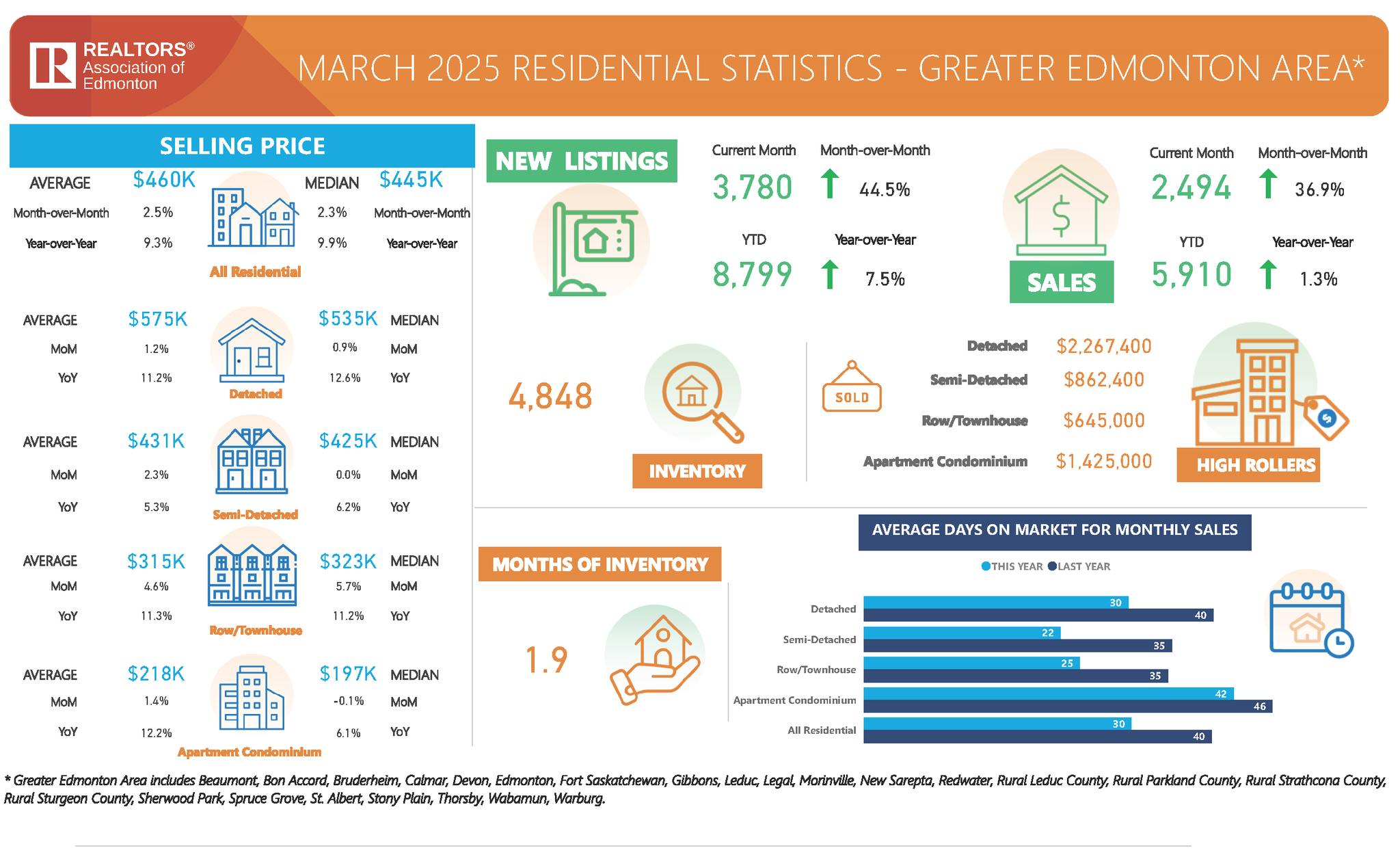

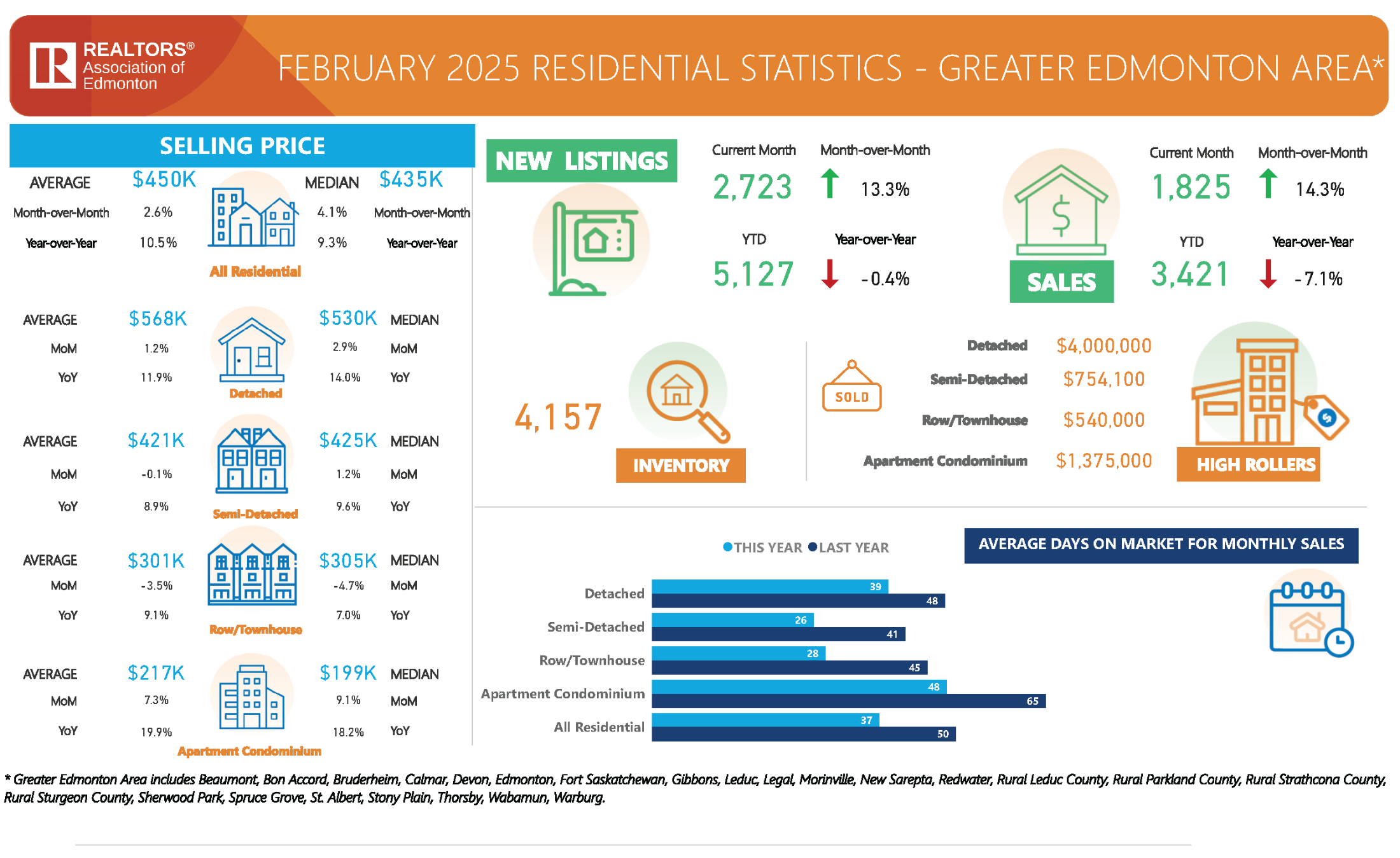

The latest real estate stats are in, and they paint a promising picture for Edmonton homeowners ready to sell. March 2025 saw significant market growth, with residential sales jumping 36.9% compared to February. The addition of 3,780 new listings means more selection for buyers, but inventory is still down 8.1% year-over-year — creating competitive conditions that favour sellers.

Detached homes led the charge, with over 1,400 units sold and an average price of $574,872 — an impressive 11.2% increase from March 2024. Row/townhouses and condos also saw rising sales and prices.

The average home in Edmonton is now selling in just 30 days, shaving a full 10 days off the market time compared to last year.

For homeowners, this is a golden window to list, with strong prices and buyer activity creating ideal selling conditions.

And for buyers and investors? The recent YEG market update shows a rise in new listings providing more opportunities, but with multiple offers becoming increasingly common, working with an expert remains key.

📲 Curious about Edmonton home prices? Thinking of selling your home in Edmonton? Contact me to book a market evaluation.

Read Full Report